Theft and embezzlement are common in medical practices, and they sometimes occur without physicians being aware until it is too late. Often, the perpetrators are trusted employees. Small and medium-sized medical practices are particularly susceptible to fraud and embezzlement because too few employees are involved in financial processes to segregate duties. Practices lose an average of 5% to 10% of revenue to fraud each year.1 This is certainly not insignificant and could negatively affect physicians’ income.

The Medical Group Management Association (MGMA) studied 945 practices and found that 83% (n = 782) had been victims of employee theft.2 Because this study utilized a survey completed by a physician or administrator, there is a chance that the person was unaware of theft that had occurred in a practice. Therefore, I believe that closer to 100% of practices have been victims of theft. In addition, theft does not always involve cash but could include simpler goods such as pens, toilet paper, and even time.

So, how do you mitigate the risk of theft in your practice? Trust, but verify. The purpose of this article is not to induce paranoia or distrust but rather to educate and to help set up checks and balances to reduce theft. It is impossible to completely prevent employee theft. However, medical practices can and should assess their vulnerabilities and take steps to mitigate the risks.

AREAS OF VULNERABILITY

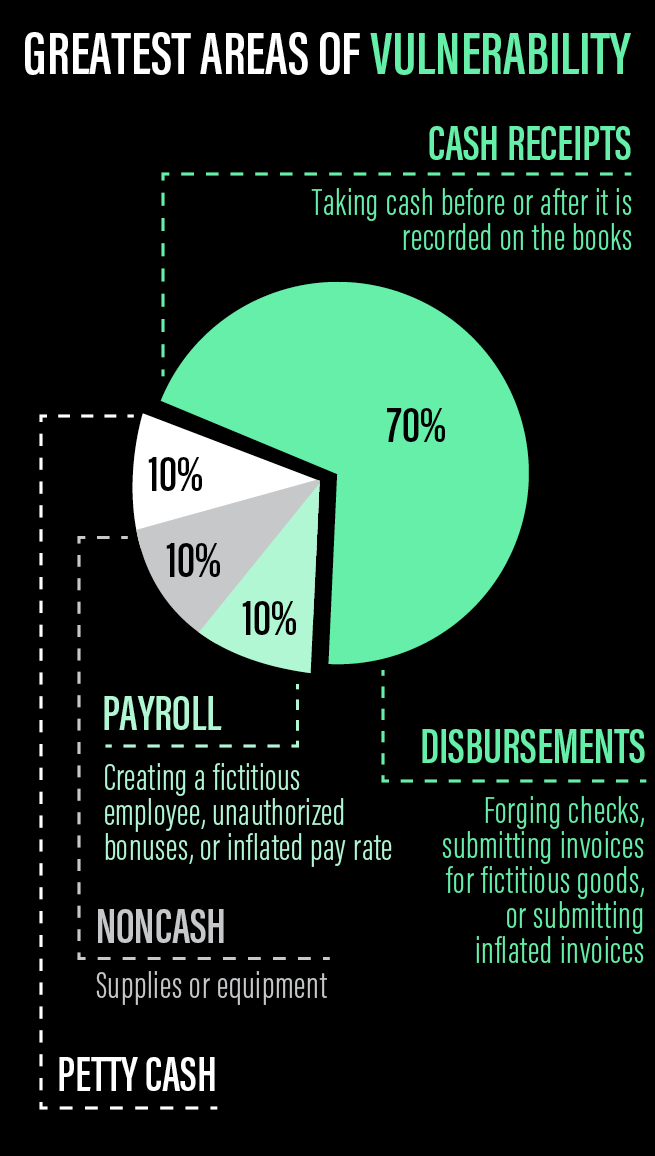

The greatest areas of vulnerability within a medical practice include cash receipts (taking cash before or after it is recorded on the books) and disbursements (forging checks or submitting fictitious or inflated invoices). These areas accounted for about 70% of theft in the MGMA study.2 Petty cash, noncash (supplies or equipment), and payroll, such as creating a fictitious employee, unauthorized bonus, or inflated pay rate, each made up 10% of theft.1 Focusing your efforts on protecting the most vulnerable areas within your practice can help reduce most theft.

HOW AND WHY

How and why do honest people steal? The rule of thumb among forensic accountants and auditors is the 10/10/80 rule: 10% of employees will always steal, 10% will never steal, and 80% will steal under the right set of circumstances. So, what are the so-called right circumstances?

1. Financial pressure: could be the result of an addiction, loss of household income, medical bills, debt, accident, or greed.

2. Rationalization: begins with “just borrowing” and the intention of paying it back.

3. Opportunity: the perception of borrowing or stealing without getting caught and why theft can spiral out of control in a short amount of time.

ASSESSING POTENTIAL EMPLOYEES

Assessing potential employees is a vital part of the hiring process that is often overlooked and ignored. All potential employees must be thoroughly screened. Many companies offer services to verify past employment, call references, check criminal and civil history, and provide credit checks for less than $100 per candidate. This is money well spent as this is the time when red flags will typically show up.

There are some limitations to credit checks, but this measure generally provides valuable information about a potential employee’s need for money and the risk of possible theft. More than 76% of practices in the MGMA study did not perform credit checks. Eleven states limit employers’ use of credit information, so be sure to contact your state department of labor before conducting credit checks on potential employees.

The good news is that, according to the Association of Certified Fraud Examiners, 39.1% of occupational fraud is detected using tips from others, 16.5% through internal audits, and 13.4% by management review. Several other ways may be effective, ranging from accidental discovery to personal confessions.1 Overall, prevention is the key to early detection.

Start preventing theft by doing the following:

- Screen job applicants thoroughly;

- Assess high-risk areas, including copays, mail receipts, disbursements, patient refunds, and payroll;

- Segregate duties so that the employee who opens the mail is not be the same employee who posts and deposits payments;

- Conduct unscheduled audits and create a perception of detection by monitoring processes and testing compliance;

- Implement strong accounting controls with proper checks and balances; and

- Invest in software and monitoring equipment.

BE AWARE

Indispensable employees often manipulate perceptions to appear that way. Pay attention to changes in employees’ behavior and be alert to disgruntled or stressed employees as well as those whose lifestyle seems beyond their means. Observe and investigate territorial behavior. Often, perpetrators will take advantage of being alone in the office, so make sure you assign different employees to open and close the practice. We tend to reward loyal and dedicated employees, but be wary of those who never take time off. Every employee should be required to take at least 1 week of vacation annually. Most importantly, trust your instincts.